Environmental, Social & Governance (ESG)

Science Based Targets initiative (SBTi)

In February 2024 RWS submitted two GHG inventories for review by the SBTi Target Validation Team. The SBTi Target Validation team classified RWS’s scope 1 and 2 target ambition and has determined that it is in line with the 1.5°C trajectory. SBTi also notes in its report that RWS has chosen to report its emissions outside the minimum boundary.

UNGC and SDGs

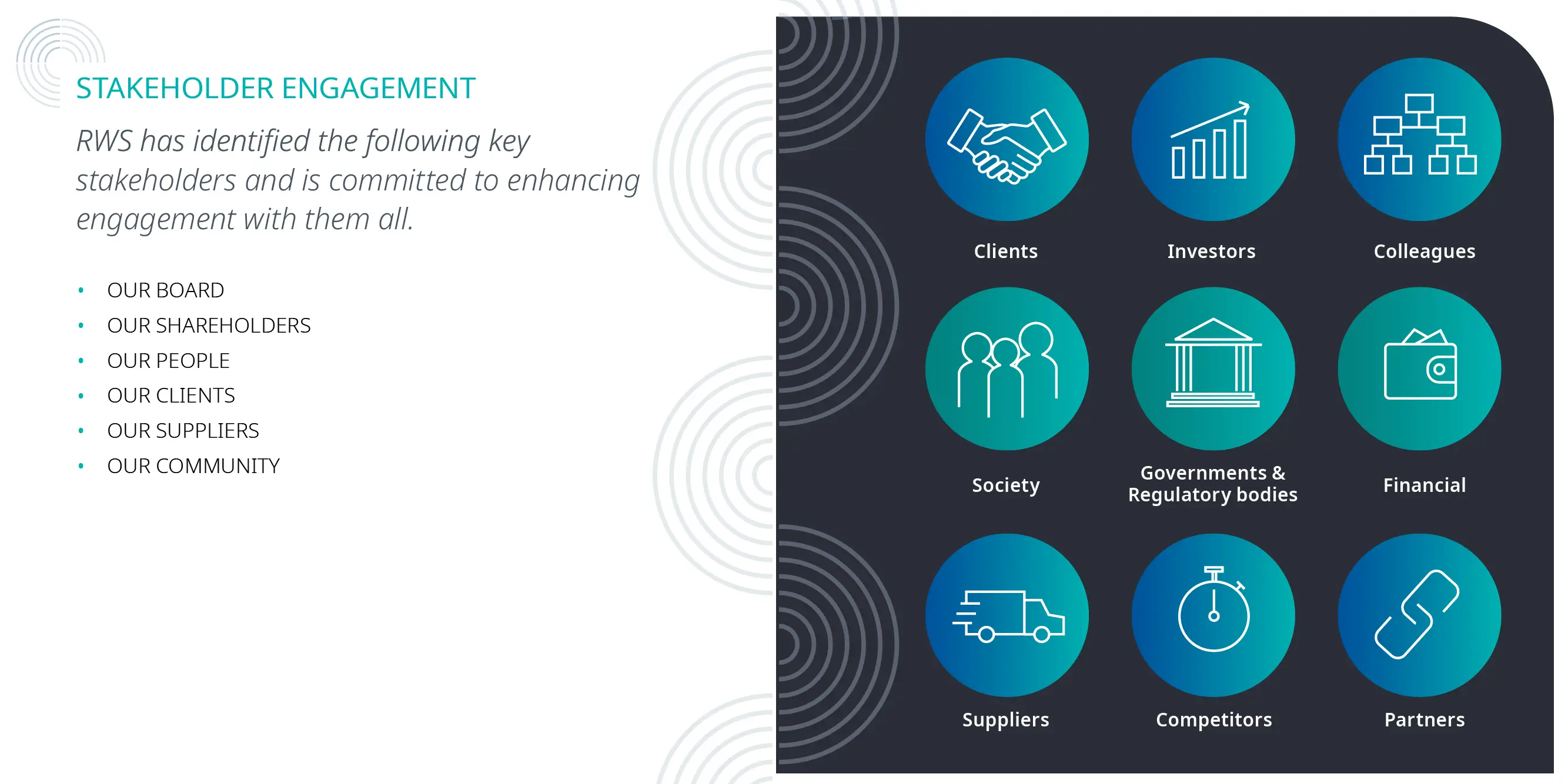

Stakeholder engagement

Four pillars of sustainability

Sustainability Accounting Standards Board Disclosure (SASB)

RWS has chosen to report by disclosing sustainability topics and certain accounting metrics in line with the SASB Standards. In August 2023, the International Sustainability Standards Board (ISSB) of the IFRS Foundation assumed responsibility for the SASB Standards. The ISSB has committed to maintain, enhance and evolve the SASB Standards and encourages preparers and investors to continue to use the SASB Standards.

RWS is supportive of the SASB framework as it allows companies to provide comparable and consistent ESG related data. We have modified some metrics to reflect our domicile in the UK. In addition, we have provided additional metrics where we believe they will provide further information regarding a specific sustainability topic.

We have chosen to report in conformance with the SASB Standard for the Professional & Commercial Services industry, which includes the following disclosure topics: